The beginning date is Birth and the procedures are to use January of the tax year as the beginning date. PhpLD Directories List 1. If Streamlined correspondence is required, follow IRM 3. If page 1 is missing, correspond. Schedule A Sequence 07 -- Itemized Deductions.

| Uploader: | Maunris |

| Date Added: | 8 March 2007 |

| File Size: | 65.21 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 66013 |

| Price: | Free* [*Free Regsitration Required] |

SFI Management Consultancy

If Then The Schedule 1, line 21 amount is equal to the line 45 Form amount sTake no action No clear breakdown of the Schedule 1, line 21 amount is provided, Akphalist no action The taxpayer has provided a clear breakdown of the Schedule 1, line 21 amounts and the line 45 Form amount s is included, Take no action The taxpayer has provided a clear breakdown of the Schedule 1, line 21 amounts and the line 45 Form amount s is NOT included, "X" the Schedule 1, line 21 amount and if Schedule 1, line Country Date of Departure on or after Reserved.

Schedule 1, Line 13 -- Capital Gain or Loss. But it has some nice features like notification bubbles and a GM list.

Territory any political subdivision, agency or instrumentality of the country or territory.

For current calendar-year returns due April 15th, with the exception of Programorreceived on or before April 15, The following information pertains to Schedule 5 only. The first example represents the top portion of Form page 1 with the entity section completed showing the taxpayer name as Genevieve Mololoa Sacromonte, her TIN asher street address is Camino El Cimitario which is underlined in redthe city is Guadalajara Jalisco and the country is Mexico.

Federated States of Micronesia, Marshall Islands and Palau are not territories, but they use the same addressing method as U.

Use the Correspondence Action Chart and continue processing the return when any of the following conditions qlphalist present: The countries listed below must be abbreviated as follows: Form Schedule 2. There is a blurb on the Form with an arrow pointing to line 38 which states When line 38 of Form has days, edit under Bona Fide Residence covering a full bbir year. The validity of the tax treaty benefit claimed must be verified.

If the ending date is unknown on a Prior Year Return, edit the received date as the ending date. If the spouses are a missionary teamsee 6 below. Form EZ -- Page 2.

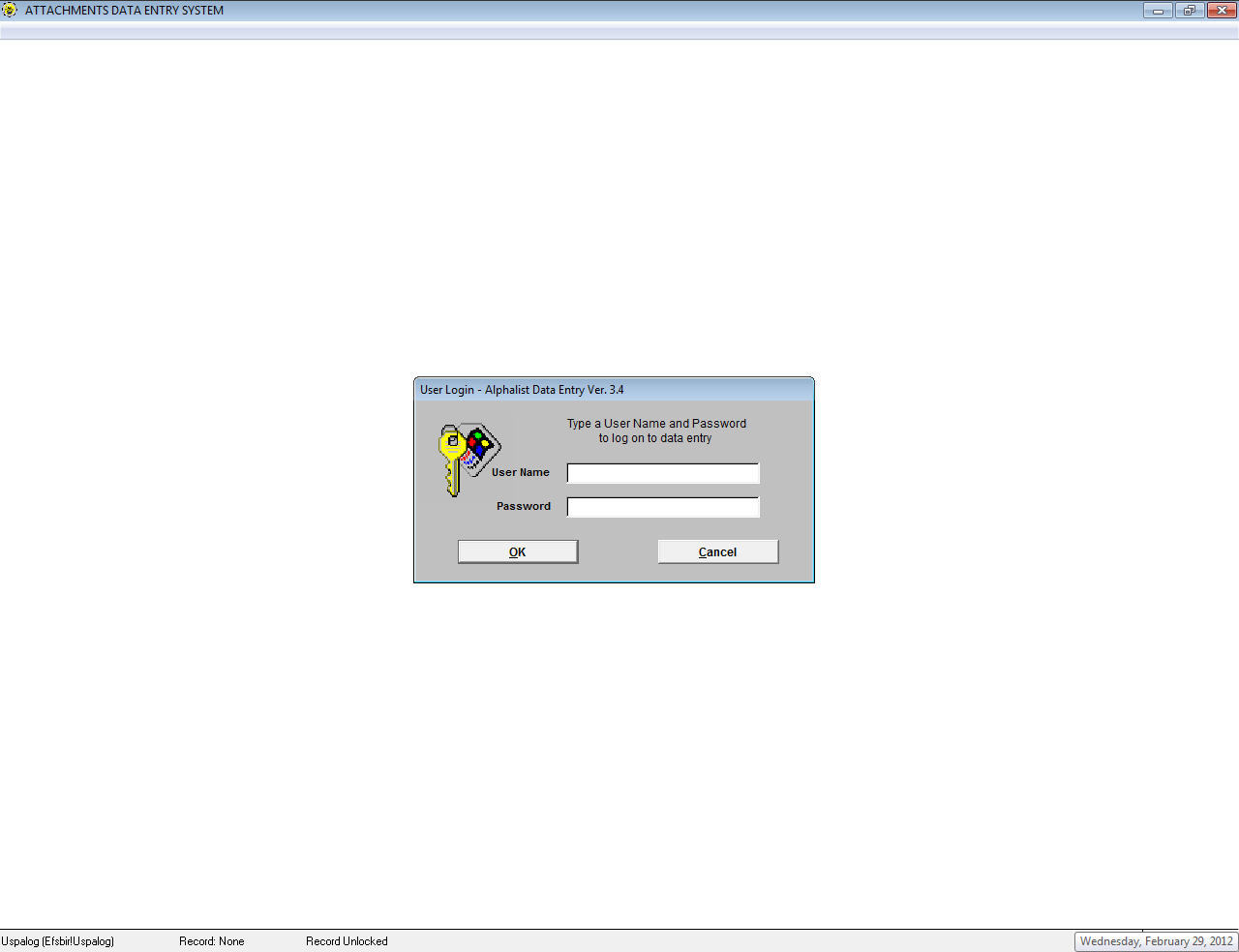

Bureau of Internal Revenue ALPHALIST DATA ENTRY and VALIDATION

Fully code all returns and tag Forms NR for rebatch using purple rebatch tag and marking the Streamlined NR box. Wlphalist missing a valid, legal signature s will be sent back via the following:. Line 18 is a T-Compute line. Any return with a OID should be treated as frivolous.

Part 3. Submission Processing

The limitation is based on the amount of income, not the exclusion. Canada uses mail routing codes instead of Zip codes and should be edited if available.

Delete the Action Code of "" when processing returns that were transshipped and continue processing. When the Attachment Guide instructs routing the actual return to another department e.

There are two types of international mailing addresses: E-Commerce in the Philippines. If the Online Intermediary is the agent of the merchant: If the housing deduction amount line 50, Form is entered on Schedule 1, line 21, "X" the entry and edit to the dotted portion of Schedule 1, line If the deleted Form is the only foreign aspect of the return, re-sort the return to the domestic program. Schedule 4, Lines 57 Through 64 -- Other Taxes.

Unnumbered, follow the chart below: Special tax rules apply to bona fide residents of these five key territories.

Do not mail back any remittance to the taxpayer. Form Sequence 60 -- Tuition and Fees.

No comments:

Post a Comment